Intrigued by the idea of achieving high returns through real estate investments? You're in the right place. With the right strategies, real estate can be a lucrative venture that offers significant financial rewards. In this blog post, we'll cover 5 proven strategies that can help you make the most out of your real estate investments. From identifying the right properties to leveraging financing options, we'll provide you with actionable tips and insights to guide you towards successful real estate investment. So, let's dive in and explore the world of real estate investment together.

Researching the Market

Some of the most successful real estate investors are those who conduct thorough research to understand the market before making any investment decisions. This is a critical step that can make or break your investment success. By researching the market, you can identify key trends and growth areas that will enable you to make informed investment decisions that will yield high returns.

Analyzing Market Trends

When researching the market, it's important to analyze current and historical market trends. This involves looking at factors such as property prices, rental rates, occupancy rates, and supply and demand dynamics. By analyzing the trends, you can identify opportunities for high returns, as well as potential risks. It's important to pay attention to fluctuations in property prices and rental rates, as well as any emerging patterns in supply and demand dynamics. This will help you make informed decisions about where and when to invest for maximum returns.

Identifying Growth Areas

Another important aspect of researching the market is identifying growth areas. These are locations that are experiencing rapid development and economic growth, which can lead to increased property values and rental income. By identifying growth areas, you can capitalize on the potential for high returns and long-term appreciation. Look for areas with strong job growth, infrastructure improvements, and urban revitalization projects. These are all indicators that a location is a potential hot spot for real estate investment.

Investment Strategies for High Returns

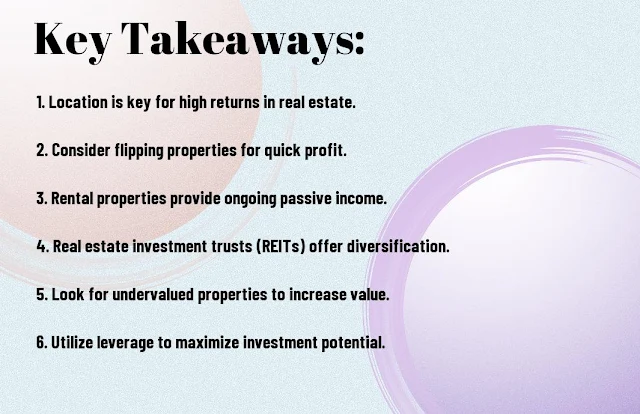

Assuming you are looking for a high return on your real estate investment, you should consider implementing proven strategies that have the potential to deliver substantial profits. Here are five investment strategies that can help you achieve high returns on your real estate investments.Buy and Hold for Long-Term Appreciation

When you opt for the buy-and-hold strategy, you essentially purchase a property and hold onto it for an extended period, typically with the intention of generating rental income and benefiting from long-term appreciation. This approach allows you to build equity in the property while the real estate market appreciates over time. However, it's important to conduct thorough research and make sure the property is located in an area with strong growth potential to ensure long-term appreciation and substantial returns on your investment.Fix-and-Flip for Immediate Profits

If you are looking for a quicker way to generate profits from your real estate investment, the fix-and-flip strategy may be your best option. This approach involves purchasing a distressed property, making necessary renovations and improvements, and then selling it for a higher price to turn a profit. While this strategy has the potential for immediate profits, it also comes with its own set of risks. You need to accurately assess the costs of renovations and accurately predict the resale value of the property to ensure a successful flip. However, when done correctly, fix-and-flip projects can yield significant returns on your investment in a relatively short timeframe.Advanced Real Estate Investment Techniques

Keep your real estate investment portfolio diversified and balanced by utilizing advanced investment techniques. Here are some strategies to consider:

- Utilizing Leverage Wisely

- Investing in Real Estate Investment Trusts (REITs)

- Exploring Commercial Real Estate Opportunities

- Diversifying with Vacation Rentals

Utilizing Leverage Wisely

When using leverage in real estate investments, it's important to be cautious in order to avoid taking on too much debt. You can use leverage to increase your purchasing power and potentially magnify your returns, but it can also amplify losses if the property doesn't perform as expected. Make sure to calculate your risk tolerance and only take on leverage that you can comfortably manage.

Investing in Real Estate Investment Trusts (REITs)

REITs offer the opportunity to invest in real estate without actually owning physical properties. These investment vehicles can provide you with regular income and long-term capital appreciation. However, it's important to thoroughly research and analyze the performance of the REIT, as well as understand the specific assets within its portfolio, to make an informed investment decision.

Exploring Commercial Real Estate Opportunities

Investing in commercial real estate can provide you with higher potential returns compared to residential properties, but it also comes with greater risk and requires a larger investment. Commercial properties such as office buildings, retail centers, and industrial complexes can offer long-term leases and stable cash flow. However, it's crucial to thoroughly understand the commercial real estate market and consider factors such as location, tenant mix, and economic trends.

Diversifying with Vacation Rentals

Adding vacation rentals to your real estate portfolio can offer higher rental income compared to traditional long-term rentals. However, this type of investment comes with additional management responsibilities such as marketing, maintenance, and dealing with seasonal fluctuations. It's important to carefully research the vacation rental market in your desired location, analyze the potential cash flow, and consider the impact of tourism trends.

Risk Management and Legal Considerations

To ensure a successful real estate investment, it is crucial to be mindful of potential risks and legal considerations. By taking proactive measures and understanding these factors, you can safeguard your investment and maximize returns.

Mitigating Investment Risks

When investing in real estate, it's essential to mitigate potential risks that could impact your returns. One way to do this is by thoroughly researching the market and property you're interested in. Conduct a comprehensive due diligence process, including property inspections, market analysis, and financial projections. Additionally, consider diversifying your real estate portfolio to spread out risk across different types of properties and locations. This can help to protect your investment from market fluctuations in specific areas or property types.

Navigating Legal and Tax Implications

Understanding the legal and tax implications of real estate investing is crucial to ensure compliance and optimize your returns. Familiarize yourself with local property laws, zoning regulations, and landlord-tenant laws, as they can have a significant impact on your investment. Additionally, consult with a qualified tax professional to fully grasp the tax implications of your real estate investments. This includes understanding the tax benefits, deductions, and potential liabilities associated with owning and managing real estate properties.

Conclusion

Upon reflecting on the 5 proven strategies for investing in real estate for high returns, you now have a solid understanding of the key principles and tactics needed to succeed in this lucrative market. By diversifying your investments, leveraging other people's money, identifying high-growth areas, adding value through renovations, and staying informed on market trends, you are well-equipped to make smart and profitable real estate decisions. Remember, real estate investment is a long-term game, so remain patient and persistent in your pursuit of high returns. With these strategies in mind, you are ready to take on the real estate market with confidence and ambition.